VCG/VCG via Getty Images

Thirty-three percent of all the money spent on personal luxury goods last year was spent by Chinese buyers. And that number is going up fast. Bain Company released a report recently, saying that by the year 2025, it's expected that nearly half of all the money spent on these goods will be spent by people from China.

Chinese buyers are already spending a lot more on personal luxury goods than American shoppers now. Because even though the Chinese economy isn't quite as big or advanced as the U.S. economy, China has almost four times as many people as the U.S. And as the Chinese middle class has grown in the last few decades, so has its purchasing power.

That has had an enormous impact on the luxury goods market. Aimee Keane of the Financial Times joins us today to tell us how.

Transcript

CARDIFF GARCIA, HOST:

Hey, everyone. This is THE INDICATOR FROM PLANET MONEY. I'm Cardiff Garcia. And I'm joined today by Aimee Keane, the host of the "Behind The Money" podcast at the Financial Times, but more importantly, my former chief collaborator back when we started "Alphachat" together when I was at the FT. Aimee, how are you?

AIMEE KEANE: Hey, Cardiff. Nice to be here.

GARCIA: Yeah, it's awesome to have you. And you have brought us a story, and it's about an industry that I know nothing about - the luxury goods market. And you know that I know nothing about it because of how I dress, I guess (laughter).

KEANE: That's not a Louis Vuitton shirt you're wearing today.

GARCIA: Absolutely not. So kick us off. Where did this story begin?

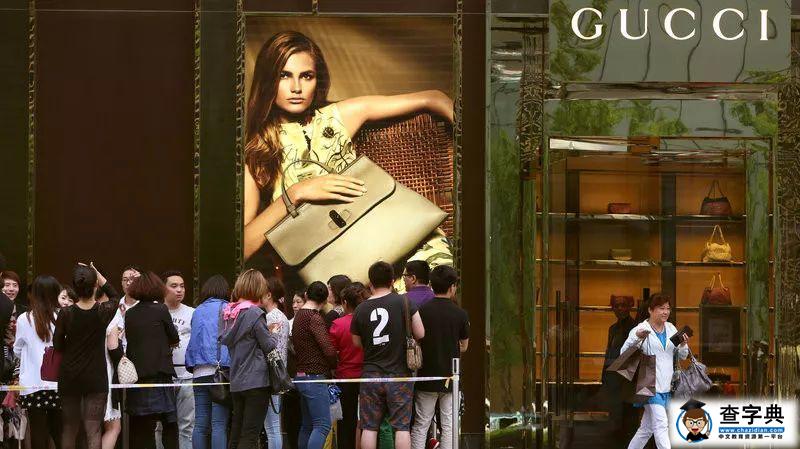

KEANE: So it all started back at my desk at the FT. I had been following my colleagues' reporting on the luxury market. And I was hearing about these big luxury conglomerates that house these brands, brands like Gucci and Louis Vuitton. And I was looking at what they were earning. And I noticed something - each quarter, executives would talk about the growth they were seeing and how it was mostly coming from China. Take a listen.

(SOUNDBITE OF ARCHIVED RECORDING)

UNIDENTIFIED PERSON #1: The strong growth was broad based with double-digit increases in all main markets, led by mainland China.

UNIDENTIFIED PERSON #2: Asia Pacific was a key driver.

UNIDENTIFIED PERSON #3: And finally, a very strong performance in Asia with more or less all businesses growing double digits.

KEANE: So those are executives from Kering, LVMH and Richemont. They're all talking about China, right?

GARCIA: Luxury brands.

KEANE: Exactly, luxury - the conglomerates that has these luxury brands. But here's what stumped me. I wondered, how could China be responsible for growth in sales of these personal luxury goods if the Chinese economy was also suffering? We've all heard about what the U.S.-China trade dispute is doing to the economy.

GARCIA: We've covered that at length here on the show, of course.

KEANE: Exactly. And so I wondered, how could this also be the place where people are spending more money on pretty expensive things?

GARCIA: Right. You'd think that slowing economic growth in China would also start to have a kind of adverse effect on Chinese people buying goods.

KEANE: Exactly. But it turns out that not only does China account for a growing share of these high-end purchases, it's actually transformed much of the way the personal luxury goods industry works.

GARCIA: OK. So the Chinese consumer changing the way that all of these brands from outside of China do business. So to find out how, you got to wait till after the break, and then Aimee's going to tell us all about it.

(SOUNDBITE OF AD)

GARCIA: Aimee, you didn't just bring us the story. You also brought with you an indicator.

KEANE: I did - an indicator, my first indicator.

GARCIA: Let's do it.

KEANE: All right. Today's indicator is 33%, as in 33% of all the money spent on personal luxury goods last year was spent by Chinese buyers. And that number is going up fast. By the year 2025, it's expected that half of all the money spent on these goods is going to be spent by people from China.

KEANE: That's according to Bain Company.

GARCIA: Yeah, worth noting here also that Chinese buyers are already spending more on personal luxury goods than American shoppers are now because even though the Chinese economy is not yet as big and certainly not as advanced as the U.S. economy, China does have almost four times as many people as the U.S. And so as the Chinese middle class has grown in the last few decades, so has the purchasing power of all those buyers.

KEANE: Exactly. So Robert Burke is a former luxury retail executive with Bergdorf Goodman, and he now runs his own consultancy here in New York. He does analysis about the industry. Here's what he had to say about the rise of China's luxury shoppers.

ROBERT BURKE: When you think about it, every day in China, there are two new billionaires. So I think what's happened with the luxury brands is it's not about the number of customers, but it's about the strength of the customers you have.

GARCIA: So it's the strength of the customer. But, Aimee, it is also a little bit about the number of the customers too, right? I mean, these brands aren't just appealing to the billionaires. They're also appealing to the middle and the upper classes. So what are these brands doing to appeal to this rising number of Chinese people who just have more money to spend now?

KEANE: So what brands have been doing is they've actually started producing and selling more accessibly priced items. And it used to be that it was a bit of a taboo in the world of luxury goods. These brands are known for having handbags in the thousands of dollars. And now maybe they've got a flip flop or a small leather wallet that's a little bit more affordable.

GARCIA: But still in the hundreds of dollars - right? - just not the tens of thousands of dollars. OK.

KEANE: Exactly. Here's Robert again.

BURKE: Today, it's recognized as, you know, if you have a $400 or $500 item and you're a luxury brand, that's - there's nothing wrong with that. In fact, that's a good thing because that may be the entry level for this consumer. It doesn't mean that the consumer - that you're going to harm the brand today.

KEANE: So with more Chinese shoppers looking to get a taste of luxury, these small, relatively less-expensive items are the perfect place to start.

GARCIA: Yeah, relatively being the important term here.

KEANE: It's all relative.

GARCIA: Still expensive but a lot cheaper than those super-tens-of-thousands-of-dollars-expensive items.

KEANE: Exactly. But demand from China hasn't just changed the products that these brands sell. It's also altered the way these brands interact with their customers online.

How has social media played a role in this?

BURKE: Social media has been everything.

KEANE: So it's not just - it's just not - not just a bit part, it's everything.

BURKE: It's not just a little...

KEANE: So brands have tapped into the most popular social media sites in China - Think WeChat, which is kind of like this hybrid social media site where you can both chat with friends and make payments.

GARCIA: So it's like WhatsApp, but you can pay for stuff.

KEANE: Basically. But there's also a site called the Little Red Book. And these brands that we've been talking about, they're all on these sites.

BURKE: You know, we as Westerners can sometimes be very arrogant that the customer - the consumer should understand us. And the brands have realized today that have been successful that, no, you have to understand the Chinese customer.

GARCIA: OK. So we've now established that even with all the anxiety about the global economy right now, the Chinese consumer, at least, is still keeping the luxury goods industry in a reasonably healthy place. It's also changing the nature of the industry itself. Aimee, all this kind of reminds me of what started to happen in the movie industry a few years ago. So, like, as China started to become a bigger and bigger share of box office sales for movies, the stories in those movies and the settings of some of these big Hollywood blockbuster films, they also started to adjust to the perceived wishes of the Chinese moviegoers.

So, like, they started incorporating more Chinese plotlines. There was even Chinese product placement. Like I remember Stanley Tucci sipping on a carton of Yili milk - that's this Chinese milk brand - in one of the Transformers movies in just a really obvious way. And it just all kind of makes me wonder whether this trend also applies to other industries as well. What do you think?

KEANE: Yeah. So, I mean, luxury goods, movies, entertainment - these are all categories where it's pretty clear that the specific circumstances and the tastes of the Chinese consumer, it's affecting how these various brands do business, right? But there are others. There's been a ton of research about how foreign brands should market their products differently in China, what they can do to appeal specifically to this customer.

For example, Chinese buyers - they tend to use online reviews of products, including those from people they know, more than, say, those of us in other countries. And there's been stories about how Chinese customers have increasingly become interested in foreign art, also foreign wine and alcohol. So there's a pretty good chance that it's having an effect on those markets as well.

GARCIA: Yeah, that makes sense. Here's another question worth asking. Isn't it a little bit dangerous, in the case of the luxury goods industry, that it has become so dependent on China for growth?

KEANE: Yeah. So, like, what if the Chinese economy continues to slow down?

GARCIA: Exactly.

KEANE: Well, that was my original question. But Robert, at least, says maybe not.

BURKE: The luxury sector of luxury goods are not going to slow down. And I don't say that in an arrogant way. And, you know, for the high luxury brands, for the customer that's buying these products because they want to be distinguished socially, there's not going to be a slowdown.

KEANE: In other words, analysts say that the pool of potential luxury shoppers in China is just so big. And China does have a lot of inequality. So it's possible that even if some parts of the Chinese economy slow down, premium designer brands just might not be affected.

GARCIA: Yeah, not for the best of reasons - right? - because of that inequality, but at least in terms of how it affects this specific industry, it might continue. Aimee Keane, what a pleasure this has been.

KEANE: It's been a lot of fun. Thanks, Cardiff.

GARCIA: Where can people find more of your work?

KEANE: Yeah, so "Behind The Money," the podcast that I produce.

GARCIA: One of my faves, bi-weekly podcast, yes.

KEANE: Thank you. You can get it wherever you get the rest of your podcast - and, of course, ft.com.

GARCIA: Perfect. This episode of THE INDICATOR was produced by Rachel Cohen, fact-checked by Emily Lang and edited by Paddy Hirsch. THE INDICATOR is a production of NPR.

+ Related Topics

Yield Curve : You Asked, We Answer

【How China Transformed The Lux】相关文章:

★ 手指靠近眉心,为何出现酸酸的感觉?难道真有第三只眼存在?

★ 双胞胎女儿长得不一样,爸爸质疑非亲生,听完医生解释后尴尬了

★ 还在为孩子学习发愁?优秀父母只做一件事,轻松教出学霸孩子

★ 小伙用记号笔在手上乱画,随后给小鸭子看,接下来一旁的人笑喷

★ 我怎么知道肚子里有蛔虫?儿童蛔虫症可以用这种民间方法来看!

★ 7月运势旗开得胜,喜鹊狂叫,桃花运飘飘进家门,旧情复燃的星座

★ 夏季坐月子太难熬?破掉这6大“不能”的谣言,月子期可以很轻松